In this article we will go over what compound interest is, what inflation is, and the effects inflation can have on your savings long term.

What is compound interest?

Interest is the price paid for borrowing money.

When you put money in a savings account, the bank pays you interest. This is because you are lending them your money. The bank then pays you a percentage of that money back each year

Bonds are similar, when you buy bonds from the government, you are loaning them money. The government then pays back the loan at an agreed interest rate, plus the original investment. Premium bonds work in a similar way but instead of guaranteed interest, you have a percentage chance of winning back the money.

So compound interest is when you re-invest or save the interest paid to you every year, growing the amount of money you earn interest on every year. Let's look at an example.

Final Nominal Value

| Year | Starting Balance |

Interest Earned (that year) |

Ending Balance |

|---|

With the initial amount saved at 1000 with an annual interest of 4%, for 30 years. Note how over 20 years, the amount has doubled to 2,191.12, and tripled to 3,243.40 over 30 years.

Seems pretty positive, so how does inflation fit in?

What is inflation?

Inflation is the increase in the average price of goods and services. Inflation is caused by rising production costs, increased demand for a service or product and government monetary policies. An example of inflation is when food prices increase due to war or climate disasters in a food producing country which causes a drop in production of food.

Depending on what you spend your money on will dictate what your personal inflation rate will be. If you take a lot of flights abroad and accommodation and travel costs increase, your personal inflation rate will be higher. If you outright own your own house, mortgage rates and house prices won't affect you at all.

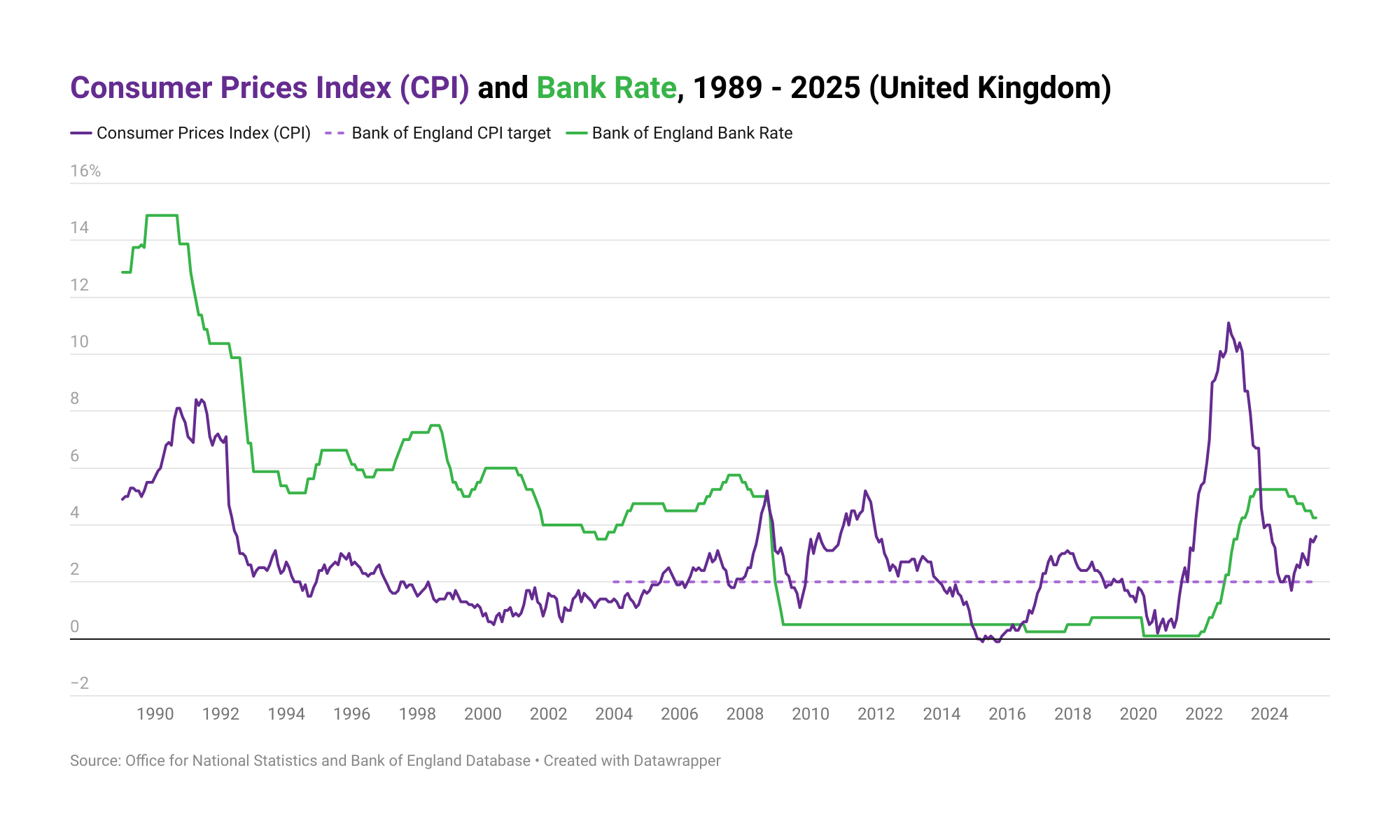

The average annual inflation, using Consumer Price Index, has been 2.58% over the last 30 years. This is a good enough rate to use to help guide what your inflation rate could be.

Impact of Inflation on Savings

Final Nominal Value

| Year | Starting Balance |

Interest Earned (that year) |

Ending Balance |

Real Value (Today’s £) |

|---|

Note that over 30 years the real savings value is 1,510.50, which is only a growth of ~50% from the original 1,000. So even with a decent interest rate of 4%, inflation impacts how much of the growth makes you better off.

Let's take a look at the inflation rate vs the cash savings rate over the past 25 years.

Source: https://closer.ac.uk/data/inflation-and-interest-rate/

Inflation is not guaranteed to be less than the bank of england savings rate. In fact the majority of the time between 2008-2024 inflation was greater. This does not inspire confidence in saving using cash savings account, and having your savings grow in real-terms.

So how can you save and beat inflation? How can you grow your savings, and not have them diminished by the rising cost of living? See TODO: insert blog post here about beating inflation